6 Predictions For Crypto Industry In 2021 (without trading)

Sergey Baloyan

Entrepreneur, X10.Agency Founder

The Blockchain and Crypto world is changing in a blink of an eye. One trend replaces another, new promising tokens, fundraising methods, community interaction approaches appear every new month.

2020 was exciting for those who monitor and participate in the crypto market - DeFi and DEX boom, ETH 2.0 launch, new interesting projects and niches, and surely BTC broke through its ATH - caught everyone's attention.

As I cooperate with lots of fintech and blockchain companies, I'm able to detect new trends and I feel that sharing my opinion with you can be important. What should we expect from 2021. (But let's put aside trading advice and BTC or other currency price rate prediction).

2020 was exciting for those who monitor and participate in the crypto market - DeFi and DEX boom, ETH 2.0 launch, new interesting projects and niches, and surely BTC broke through its ATH - caught everyone's attention.

As I cooperate with lots of fintech and blockchain companies, I'm able to detect new trends and I feel that sharing my opinion with you can be important. What should we expect from 2021. (But let's put aside trading advice and BTC or other currency price rate prediction).

1. DeFi and DEX will continue their growth

This year was truly impressive for the DeFi segment. A rapid growth of locked USD in different projects (currently it is estimated as 13.5 Billion), the rise of new interesting projects, the whole world got familiar with words 'staking', 'farming' and 'governance token'.

I guess that 2021 will bring more and more projects and a higher supply on DeFi market. Nevertheless, always mind financial security and doublecheck information about the projects and do not trust in super fast profits only by word.

Decentralized Exchanges, so-called DEX, are coming alongside with DeFi Industry. 2020 year was a real breakthrough for many of DEXs, UniSwap is the most vivid example. This tendency will only get stronger during the upcoming 2021 as well as the IDO trend.

Decentralized Exchanges, so-called DEX, are coming alongside with DeFi Industry. 2020 year was a real breakthrough for many of DEXs, UniSwap is the most vivid example. This tendency will only get stronger during the upcoming 2021 as well as the IDO trend.

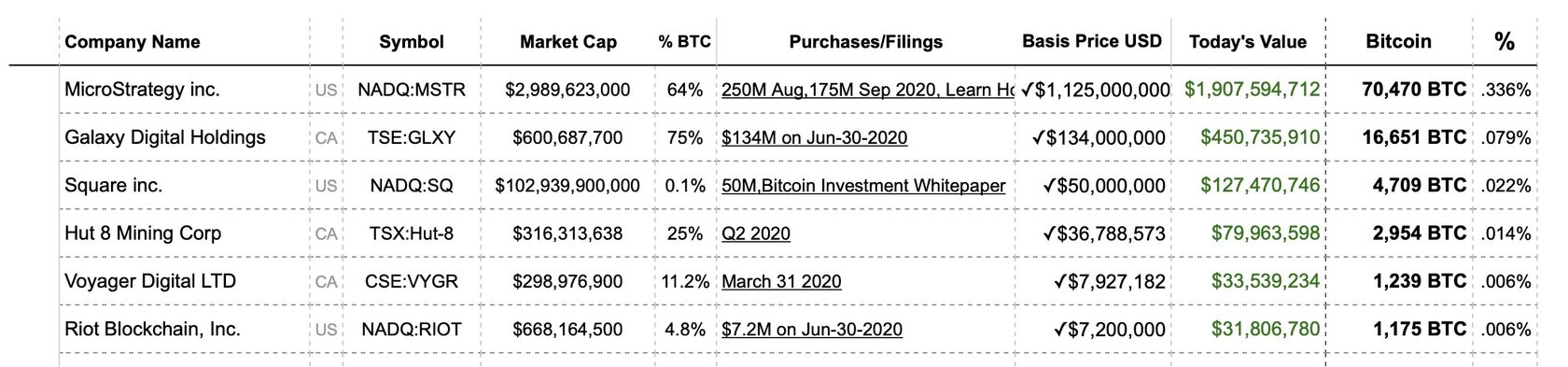

2. International companies and institutional investors turn to BTC.

This year, several companies announced that they are converting part of their reserve assets to BTC. The loudest of them are, for example, MicroStrategy, PayPal, Galaxy and Square. And literally every month there are reports of new similar deals. Of course, this is a positive sign for the entire market. I think this trend will keep going in 2021. At the same time, such giants buy such large volumes hardly for quick speculation, which means that they will HODL their Bitcoins. This, in turn, should have a positive impact on the price of the main asset.

By the way, you can follow the companies that buy BTC here.

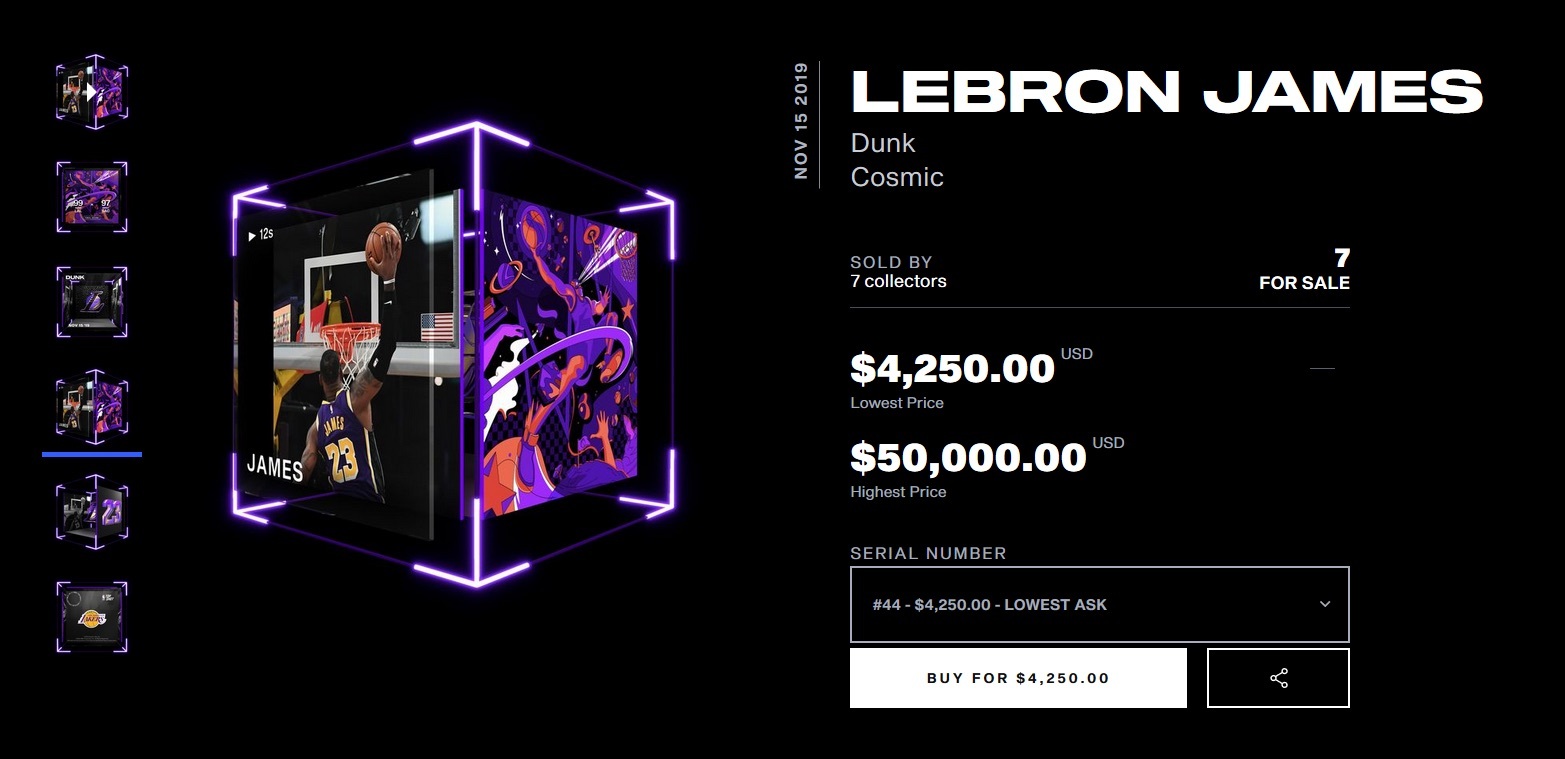

3. Growth of NFT tokens and projects.

I wrote this year about NFT tokens and what is it. The idea itself is not new and has existed in the crypto market for quite a long time. Even there were already quite high-profile cases, for example, one of Andy Warhol's paintings was tokenized and sold in this way.

In 2021, NFTs will develop faster. After all, there are a huge number of different applications, that also include not only games and arts. It can be implemented in lots of industries: from real estate to law.

And already big media giants like the NBA and UFC are starting to work with NFT industry.

And already big media giants like the NBA and UFC are starting to work with NFT industry.

4. Central Bank Digital Currencies (CBDC).

Rumors and expert opinions that very soon many governments will begin the transition to Central Bank electronic money (that are also often called in the media as government cryptocurrencies) have been circulating since 2016.

However, this year it became clear that the world is closer to such a transition than ever before. First of all, the pace of the race was set by China. I wrote about this here. Meanwhile, China has already started testing its e-currency, and many countries have announced that they are preparing their own developments in the field of government electronic money. It is unlikely that we are waiting for an instant rejection of Fiat, but in 2021, the race between the countries will definitely heat up.

However, this year it became clear that the world is closer to such a transition than ever before. First of all, the pace of the race was set by China. I wrote about this here. Meanwhile, China has already started testing its e-currency, and many countries have announced that they are preparing their own developments in the field of government electronic money. It is unlikely that we are waiting for an instant rejection of Fiat, but in 2021, the race between the countries will definitely heat up.

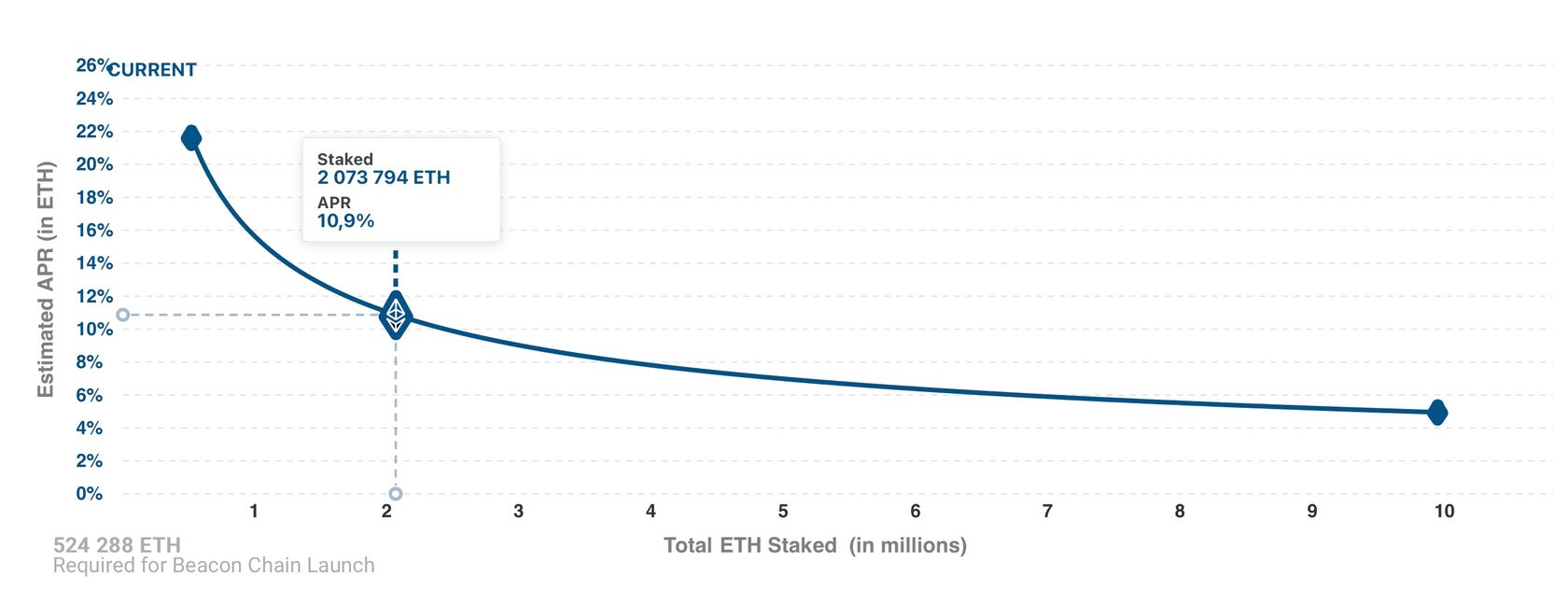

5. ETH 2.0 and the infrastructure around it.

One of the main Crypto events of 2020 was the launch of ETH 2.0. Already more than 2 million ETH are locked in the network. However, this is still only the first stage of the update. In the future, we expect a new consensus algorithm, staking, fast and cheap transactions - all this is promising and will potentially push the DeFi market with great speed. In 2021, ETH will be more interesting to watch than ever.

6. STO markets and tokenized assets will increase.

In 2020, the STO market was not very active, especially compared to the DeFi market. However, I am sure that tokenized assets have a great future. And the first news came at the end of 2020 - the SEC made an important announcement that it would raise the limit for regulated funding fees that can be raised through the so-called Regulation Crowdfunding Campaign from $ 1 million to $ 5 million. This will allow the sale of securities without registration with the SEC. Also, many European States are beginning to quietly support the possibility of tokenizing assets and raising funds in this way. And one of the largest exchanges, Bittrex Global, for example, has launched trading in tokenized shares.

Will 2021 be the year of STO? While it is difficult to say, but definitely the ice has moved, and we will see more cases and news from this area for sure.

I tried to make this review as short and at the same time useful as possible. In fact, there are many more topics that we can talk about. However, these are the trends in the industry that I see now, without touching trading topics or price predictions. We can continue our discussion in my Twitter.

Share your opinion, what trends do you see? Which of the following do you think is the biggest trend? All from 2021!

In the meantime, if you have any questions about Crypto and Blockchain or you are an IDO/DeFi/crypto project and want to know more how to promote you project, you can always contact me via Telegram (@baloyan) or LinkedIn.

Will 2021 be the year of STO? While it is difficult to say, but definitely the ice has moved, and we will see more cases and news from this area for sure.

I tried to make this review as short and at the same time useful as possible. In fact, there are many more topics that we can talk about. However, these are the trends in the industry that I see now, without touching trading topics or price predictions. We can continue our discussion in my Twitter.

Share your opinion, what trends do you see? Which of the following do you think is the biggest trend? All from 2021!

In the meantime, if you have any questions about Crypto and Blockchain or you are an IDO/DeFi/crypto project and want to know more how to promote you project, you can always contact me via Telegram (@baloyan) or LinkedIn.

Check out my previous articles at HackerNoon:

How China's New National Cryptocurrency Changes Everything

Sergey Baloyan

Entrepreneur, X10.Agency Founder

China is launching a national cryptocurrency. In this article, we'll tell you what information is already known about the project at the moment as well as how it may change the financial world.

A bit of History

In October 2019, Chairman of the People's Republic of China, Xi Jinping, said that the development of blockchain technology is one of the priorities of the state and called for accelerated growth of the industry. By that time, it was already known that China had been developing its own cryptocurrency since 2014.

News about this periodically surfaced, although most crypto enthusiasts know China more for their strict regulatory actions — significant restrictions on cryptocurrency investment, the inclusion of mining in the preliminary stop-list of industries that should be banned, closure of blockchain conferences by the police, and so on.

Much has changed since Facebook published their initial plans for Libra. The prospect of a private company with 2.3 billion users worldwide issuing its own currency made the idea much more real to governments around the world.

China took it as an incentive. First of all, to compete with the dollar in the digital payments market and, ultimately, to change the entire global financial system.

Looking at the example of China and understanding what the future may hold, many other countries have announced the development of their own CBDCs (Central Bank Digital Currencies). For example, central banks for the European Union, South Korea, Russia, Sweden and a number of other countries have announced their own developments in the field of state cryptocurrencies.

News about this periodically surfaced, although most crypto enthusiasts know China more for their strict regulatory actions — significant restrictions on cryptocurrency investment, the inclusion of mining in the preliminary stop-list of industries that should be banned, closure of blockchain conferences by the police, and so on.

Much has changed since Facebook published their initial plans for Libra. The prospect of a private company with 2.3 billion users worldwide issuing its own currency made the idea much more real to governments around the world.

China took it as an incentive. First of all, to compete with the dollar in the digital payments market and, ultimately, to change the entire global financial system.

Looking at the example of China and understanding what the future may hold, many other countries have announced the development of their own CBDCs (Central Bank Digital Currencies). For example, central banks for the European Union, South Korea, Russia, Sweden and a number of other countries have announced their own developments in the field of state cryptocurrencies.

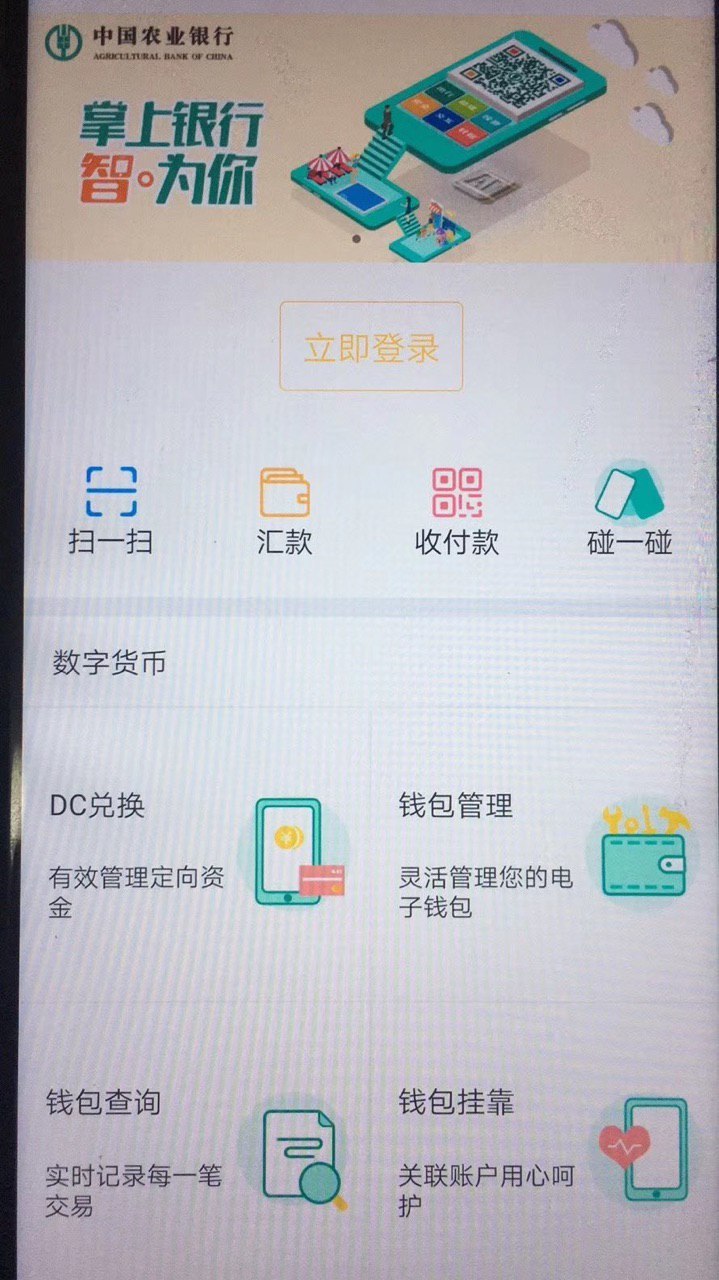

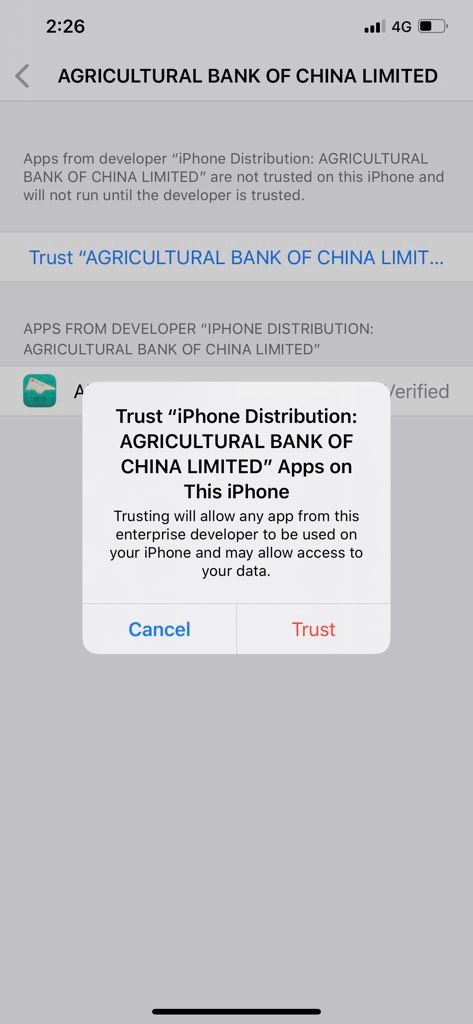

In April 2020, screenshots of the first version of the digital yuan application appeared online. According to preliminary data, the tests began among the "white list" of clients of the Agricultural Bank of China (the 7th bank in the world in terms of net profit) in four pilot regions: Shenzhen, Hong Kong, Chengdu, and Suzhou. In April, Suzhou enterprises even intend to pay 50% of transport subsidies to local workers in the new digital currency.

A couple of weeks ago, it became known that on April 25, 2020, China will launch its national blockchain platform called BSN (Blockchain Service Network). Many believe this is the first, fundamental step before the launch of a global financial project - a government-backed cryptocurrency called DC/EP. And it seems that the country is taking this initiative more seriously than ever before.

Based on the screenshots that appeared online recently, it is clear that the crypto-yuan will be launched soon enough. More and more experts are saying that this could change the entire global financial system. So, what is known at the moment and what conclusions can be drawn from it?

Based on the screenshots that appeared online recently, it is clear that the crypto-yuan will be launched soon enough. More and more experts are saying that this could change the entire global financial system. So, what is known at the moment and what conclusions can be drawn from it?

Reviewing the BSN screenshots

Several basic functions can be seen in the screenshots, and the interface is very similar to other Chinese payment platforms such as Alipay and WeChat Pay. Also, according to various statements of officials, it is already possible to understand many features and functions of the future cryptocurrency. I tried to gather all the information from different sources together.

So, what is known at the moment about the crypto yuan?

A list of all the important facts about the digital yuan:

Is this the beginning of a new financial era?

As can be seen from the information currently available, DC/EP is not the classic concept of a decentralized cryptocurrency like Bitcoin. The users themselves are unlikely to feel a significant difference in using the new system compared to WeChat Pay or AliPay. For the government, the blockchain data structure will ensure unprecedented traceability and control.

It is important to note the advantage China can gain by being the first to release a government backed digital currency at scale. Meanwhile, competing projects like Libra and Ton have been held back and forced to change by regulators.

Today, China is the second economy in the world and the least dependent on oil prices. While there's no doubt that the dollar reigns supreme today, the digital yuan is China's best chance to compete with the dollar on the global scale in the years ahead.

There is no doubt that other governments will quickly follow China's example. Perhaps we are entering a new era — the end of physical cash and the emergence of central bank cryptocurrencies. And there is a strong possibility that this will completely change the international monetary system as we know it.

To get more thoughts and insides about crypto industry you can follow my LinkedIn , Medium , Twitter

Today, China is the second economy in the world and the least dependent on oil prices. While there's no doubt that the dollar reigns supreme today, the digital yuan is China's best chance to compete with the dollar on the global scale in the years ahead.

There is no doubt that other governments will quickly follow China's example. Perhaps we are entering a new era — the end of physical cash and the emergence of central bank cryptocurrencies. And there is a strong possibility that this will completely change the international monetary system as we know it.

To get more thoughts and insides about crypto industry you can follow my LinkedIn , Medium , Twitter

• The Chinese cryptographic currency will be called DC/EP, which stands for Digital Currency Electronic Payment.

• The Central Bank has not yet officially confirmed the schedule for the introduction of the digital yuan, but many sources talk about a full launch in mid-2021.

• Besides the standard ability to receive and send payments, one of the main functions is called 'touch and touch' - it allows two people to simply touch their mobile phones to make a transfer.

• Transfers can be made without an internet connection on devices with NFC technology or Bluetooth. Offline transactions are likely to be saved and accounted for whenever the users next get online. But so far not much is known specifically about the settlement mechanism.

• Familiar features such as transfer by account number as well as generation and scanning of QR codes can already be seen on screens.

• The BSN payment system can process up to 300,000 transactions per second.

• The Chinese cryptocurrency is suitable for any financial operations because of its high throughput, including traditional retail transactions and even micropayments.

• Obviously, the crypto yuan blockchain will be centralized.

• Interestingly, the currency will not only work on the blockchain — it will be issued in two main stages: from the Central Bank to commercial banks, and from commercial banks it will already be put into circulation.

• Banks and organizations will be able to act as DC/EP issuers who can exchange the digital yuan with other fiat currencies and assets.

• Patents also indicate that DC/EP will use a two-tier architecture that allows licensed third-party payment institutions and banks to participate in the secondary issuance of digital currency.

• It appears that Alipay itself will participate in the implementation of this scheme.

• All organizations licensed to participate in the DC/EP issue will have a reserve account with the People's Bank of China.

• China also sees its own cryptocurrency as a means of counteracting new digital currencies. According to the Central Bank, a domestically issued digital currency, supported by the government and expressed in the national unit of account, can help limit the issue of private currencies and reduce the risks of financial instability.

• According to China's plan, the crypto yuan will significantly expand financial infrastructure availability in the country. At the same time, as an international means of exchange, it could improve the efficiency of cross-border payments.

• Many sources say that on March 24, the Bank of China completed the development of basic functions and began drafting laws to implement the new technology nationwide.

• One of the main challenges for the Government is to ensure that the crypto yuan enjoys the same sovereignty as the fiat yuan. Strong liquidity guarantees are promised to its holders.

• The central bank said that DC/EP is also planned to be widely used during the 2022 Olympic Games to be held in Beijing.

• The Central Bank has not yet officially confirmed the schedule for the introduction of the digital yuan, but many sources talk about a full launch in mid-2021.

• Besides the standard ability to receive and send payments, one of the main functions is called 'touch and touch' - it allows two people to simply touch their mobile phones to make a transfer.

• Transfers can be made without an internet connection on devices with NFC technology or Bluetooth. Offline transactions are likely to be saved and accounted for whenever the users next get online. But so far not much is known specifically about the settlement mechanism.

• Familiar features such as transfer by account number as well as generation and scanning of QR codes can already be seen on screens.

• The BSN payment system can process up to 300,000 transactions per second.

• The Chinese cryptocurrency is suitable for any financial operations because of its high throughput, including traditional retail transactions and even micropayments.

• Obviously, the crypto yuan blockchain will be centralized.

• Interestingly, the currency will not only work on the blockchain — it will be issued in two main stages: from the Central Bank to commercial banks, and from commercial banks it will already be put into circulation.

• Banks and organizations will be able to act as DC/EP issuers who can exchange the digital yuan with other fiat currencies and assets.

• Patents also indicate that DC/EP will use a two-tier architecture that allows licensed third-party payment institutions and banks to participate in the secondary issuance of digital currency.

• It appears that Alipay itself will participate in the implementation of this scheme.

• All organizations licensed to participate in the DC/EP issue will have a reserve account with the People's Bank of China.

• China also sees its own cryptocurrency as a means of counteracting new digital currencies. According to the Central Bank, a domestically issued digital currency, supported by the government and expressed in the national unit of account, can help limit the issue of private currencies and reduce the risks of financial instability.

• According to China's plan, the crypto yuan will significantly expand financial infrastructure availability in the country. At the same time, as an international means of exchange, it could improve the efficiency of cross-border payments.

• Many sources say that on March 24, the Bank of China completed the development of basic functions and began drafting laws to implement the new technology nationwide.

• One of the main challenges for the Government is to ensure that the crypto yuan enjoys the same sovereignty as the fiat yuan. Strong liquidity guarantees are promised to its holders.

• The central bank said that DC/EP is also planned to be widely used during the 2022 Olympic Games to be held in Beijing.