How To Stake ETH 2.0 Without Running a Node and 32 ETH

Sergey Baloyan

Entrepreneur, X10.Agency Founder

At the end of the last year, on December 1, the long-awaited new version of the Ethereum network was launched. So, now anyone who is familiar with cryptocurrencies and ETH can potentially become a validator in this network. This means, a new opportunity for passive income emerged.

Staking in Ethereum 2.0 is blocking ETH in a smart contract to participate in the network as a validator and receive a reward for confirming blocks. Staking became possible after the launch of a new version of the network on the Proof-of-Stake (PoS) consensus algorithm. This consensus algorithm is similar to well-known mining, but instead of using computational resources validators block coins in the wallet to run a special node.

To become an Ethereum 2.0 validator, you need to block at least 32 ETH for staking which is quite a lot for an average crypto investor. At the moment I'm writing this 32 ETH is more than roughly $70,000. So, this is a problem that I want to find solutions for in this article. How can an average investor stake ETH 2.0?

#A few important things before we start:

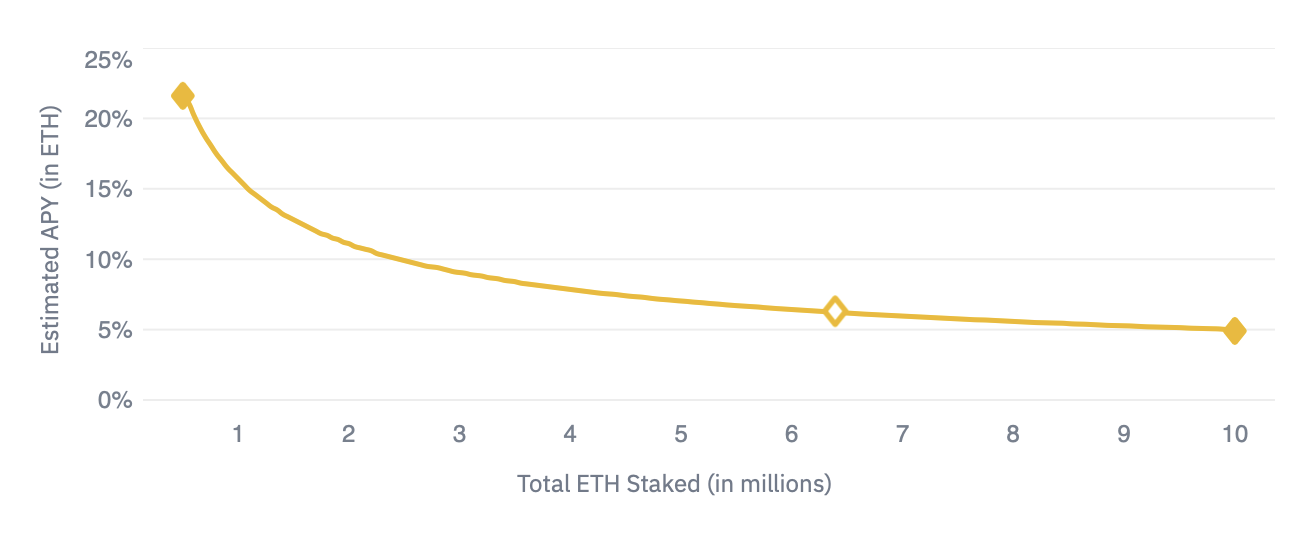

- APY isn't regular. The more ETH is staked, the lower the APY will be. Calculations in this article are based on the current APY of the day I'm writing this.

- You won't be able to withdraw your stake until future upgrades are deployed (it can take 1-2 years easily). Withdraws will be available in a minor upgrade following the merge of the mainnet with the Beacon Chain.

- This is not investment advice. Do your own research and understand all the risks.

#Staking pools:

A pool is an intermediary for people with less than 32 ETH, pooling their ETH for joint staking. Staking rewards are distributed among the pool members in proportion to the shares of how much ETH they distributed. Storage is decentralized, transparent, and secured by a smart contract. Pools charge staking fees, and some services have a limit on the minimum amount of ETH to be deposited. Most staking pools issue tokenized versions of staking-locked ETH like rETH. These ERC-20 tokens represent not only ETH but staking income as well. Tokens can have the same symbol or name. But if they are not issued by the same pool, they are different assets with different liquidity.

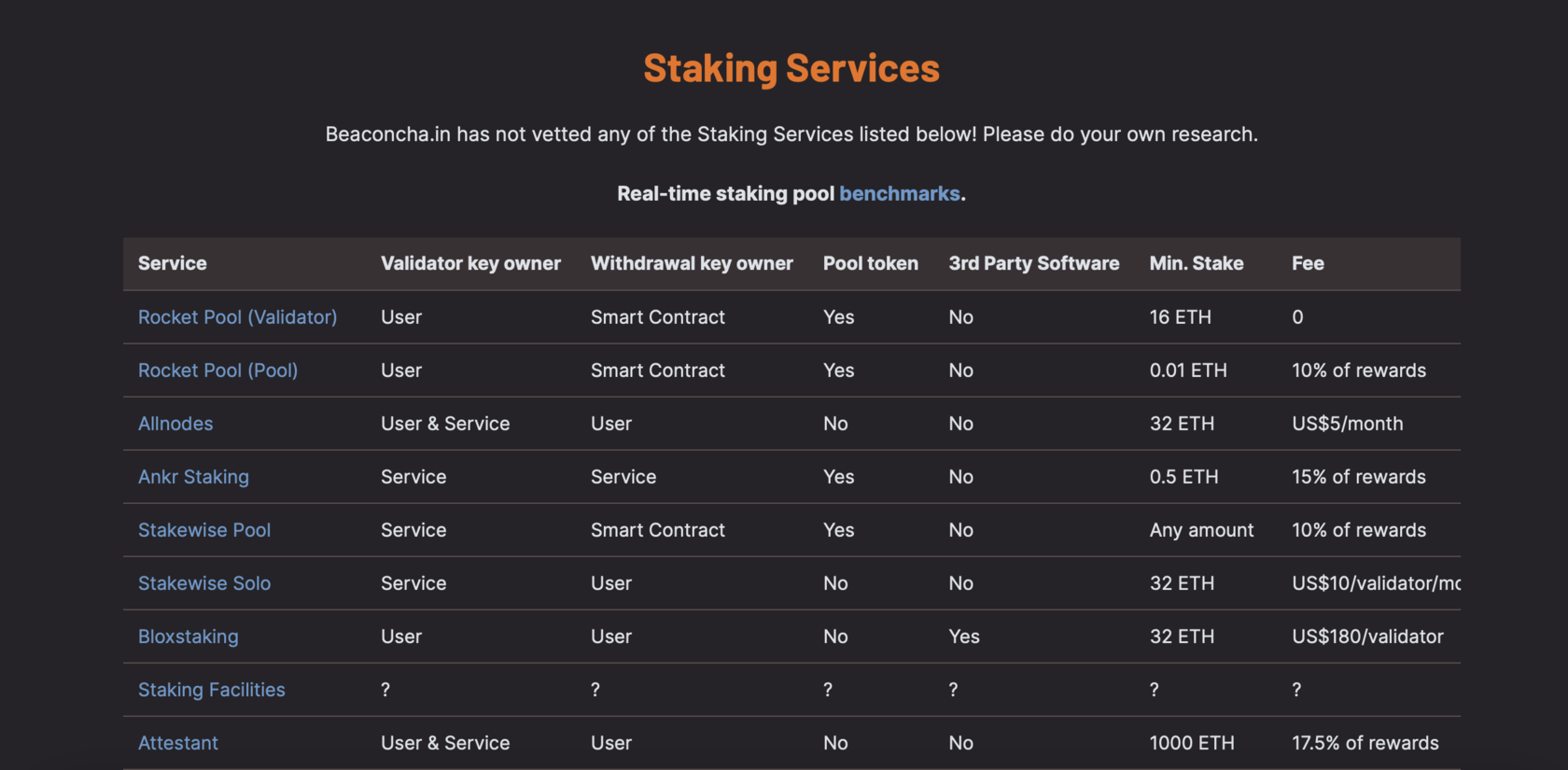

The list of active pools and their comparative analysis can be found HERE.

The list of active pools and their comparative analysis can be found HERE.

Let me take you through some examples. For instance, let's check, for example, 2 of the top providers, Ankr and Rocket Pool.

Staking via Ankr is quite comfortable but still, there is a limitation of the minimum amount of ETH to be staked. The user would stake at least 0.5 of ETH, equal to roughly $1,150 as of today. And today's APY for staking via Ankr is 9.64%. But it's important to know that Ankr charges a 15% fee on all rewards. For this fee, Ankr provides user-friendly infrastructure and synthetic asset aETH which can be immediately sold in case the owner decides to stop staking ETH. So, if the investor wants to stake 1 ETH via Ankr the rewards will be ~$0.331 net per day.

Rocket Pool has a lower minimum amount of ETH required to start staking - only 0.01 ETH which is just about $23 at the moment. Same as Ankr, Rocket Pool provides the staker with a synthetic asset called rETH which can be tradeable. APY on the Rocket Pool is 9.8% for the moment I'm writing this article. Rocket Pool charges 10% commission (and 0 commission if you stake at least 16 ETH), so if the investor stakes 1 ETH the reward will be ~$0.42 per day for now.

Staking via Ankr is quite comfortable but still, there is a limitation of the minimum amount of ETH to be staked. The user would stake at least 0.5 of ETH, equal to roughly $1,150 as of today. And today's APY for staking via Ankr is 9.64%. But it's important to know that Ankr charges a 15% fee on all rewards. For this fee, Ankr provides user-friendly infrastructure and synthetic asset aETH which can be immediately sold in case the owner decides to stop staking ETH. So, if the investor wants to stake 1 ETH via Ankr the rewards will be ~$0.331 net per day.

Rocket Pool has a lower minimum amount of ETH required to start staking - only 0.01 ETH which is just about $23 at the moment. Same as Ankr, Rocket Pool provides the staker with a synthetic asset called rETH which can be tradeable. APY on the Rocket Pool is 9.8% for the moment I'm writing this article. Rocket Pool charges 10% commission (and 0 commission if you stake at least 16 ETH), so if the investor stakes 1 ETH the reward will be ~$0.42 per day for now.

#Staking with Exchanges

One of the easiest options is to transfer ETH to a wallet on an exchange or other custodian service that offers split staking rewards. However, there's a classic risk of dealing with the centralized exchange: the user does not control the private keys.

At the moment staking ETH via an exchange is definitely can be the simplest method. An investor just needs to sign up or use an existing exchange account, deposit or buy ETH and stake it via the clear interface. Nowadays it's possible on many exchanges but since staking via an exchange is risky I would recommend using only the most reputable ones. For instance, Binance, Huobi, Coinbase, Kraken, and OKEx can be considered as relatively safe platforms for staking. Maybe later I'll write an additional article with the review of staking opportunities on different exchanges.

So, how much can you earn by staking ETH via exchanges? For instance, Binance provides convenient ETH 2.0 staking with just a few requirements. Staking assets cannot be redeemed until shard chains are launched, which can take up to 2 years. Binance provides users with BETH tokenized assets at a 1:1 ratio as proof that you have provided ETH for staking. There's no minimum amount of ETH to stake on Binance, so basically, anyone can start doing it. More, Binance charges 0% fees for its service, which is pretty unique. The APY for the moment I'm writing this is around 9.32%. So, by staking 1 ETH the user will be getting around $0.447 of rewards per day. It's very important to stress that the APY for staking will be changing over time.

Another example is Kraken exchange which provides the same service with the same conditions except one. This exchange charges ~15% fee on all staking rewards. Also, Kraken has a so-called boarding process for ETH staked. The rewards will start being generated up to 20 days after the user actually pushed the button. So, staking on Kraken will let the user gain ~$0.38 per day in case the APY doesn't change much after the 20 day boarding period.

At the moment staking ETH via an exchange is definitely can be the simplest method. An investor just needs to sign up or use an existing exchange account, deposit or buy ETH and stake it via the clear interface. Nowadays it's possible on many exchanges but since staking via an exchange is risky I would recommend using only the most reputable ones. For instance, Binance, Huobi, Coinbase, Kraken, and OKEx can be considered as relatively safe platforms for staking. Maybe later I'll write an additional article with the review of staking opportunities on different exchanges.

So, how much can you earn by staking ETH via exchanges? For instance, Binance provides convenient ETH 2.0 staking with just a few requirements. Staking assets cannot be redeemed until shard chains are launched, which can take up to 2 years. Binance provides users with BETH tokenized assets at a 1:1 ratio as proof that you have provided ETH for staking. There's no minimum amount of ETH to stake on Binance, so basically, anyone can start doing it. More, Binance charges 0% fees for its service, which is pretty unique. The APY for the moment I'm writing this is around 9.32%. So, by staking 1 ETH the user will be getting around $0.447 of rewards per day. It's very important to stress that the APY for staking will be changing over time.

Another example is Kraken exchange which provides the same service with the same conditions except one. This exchange charges ~15% fee on all staking rewards. Also, Kraken has a so-called boarding process for ETH staked. The rewards will start being generated up to 20 days after the user actually pushed the button. So, staking on Kraken will let the user gain ~$0.38 per day in case the APY doesn't change much after the 20 day boarding period.

#Lending platforms on ETH

A balanced option between staking and the ability to borrow tokens for ETH blocked in staking. Suitable for risky traders and investors looking to maximize profits. For example, there is a lending platform called LiquidStake. It's backed by Darma Capital and allows ETH stakers to borrow USDC using staked ETH as collateral.

The user can benefit from the opportunity to generate income through staking and retain the ability to trade, invest, or hold liquid crypto assets. LiquidStake consolidates customers' crypto assets and transfers them to major staking service providers. Loans can be obtained from the very first moment of ETH staking.

Let's talk numbers. Staking at LiquidStake the investor gets 9.86% APY and pays 14.91% commission on rewards. In addition to this, the investor gets the loan in USDC equal to the value of ETH staked. So, staking 1 ETH the user gets $0.4 per day for the moment I'm writing it.

The user can benefit from the opportunity to generate income through staking and retain the ability to trade, invest, or hold liquid crypto assets. LiquidStake consolidates customers' crypto assets and transfers them to major staking service providers. Loans can be obtained from the very first moment of ETH staking.

Let's talk numbers. Staking at LiquidStake the investor gets 9.86% APY and pays 14.91% commission on rewards. In addition to this, the investor gets the loan in USDC equal to the value of ETH staked. So, staking 1 ETH the user gets $0.4 per day for the moment I'm writing it.

#How profitable it is?

In the end, it's also very important to mark that the validator's reward is affected by the total number of ETH blocked for staking. Depending on this figure, the maximum annual return of the validator can range from 2 to 20%. So the profit an investor can make out of staking is not really high but is comparably stable and low-risk.

You can check the current number of total ETH staked HERE.

You can check the current number of total ETH staked HERE.

However, this profit is larger than the average interest you can get by depositing fiat money in the bank account, so ETH staking might be an interesting alternative. Still, it's important to analyze the risks of the chosen staking method and remember that the ETH price is quite volatile. So despite the staking profits, the investor can get some additional profit or loss depending on the ETH price on the market.

And, as usual, don't forget to do your own research while choosing the way to stake ETH.

And, as usual, don't forget to do your own research while choosing the way to stake ETH.

If you want to have the latest updates and researches about crypto and NFT industry and participate in different crypto contests and activities - Follow me in Twitter.

#Check out my previous articles at HackerNoon:

How China's New National Cryptocurrency Changes Everything

Sergey Baloyan

Entrepreneur, X10.Agency Founder

China is launching a national cryptocurrency. In this article, we'll tell you what information is already known about the project at the moment as well as how it may change the financial world.

A bit of History

In October 2019, Chairman of the People's Republic of China, Xi Jinping, said that the development of blockchain technology is one of the priorities of the state and called for accelerated growth of the industry. By that time, it was already known that China had been developing its own cryptocurrency since 2014.

News about this periodically surfaced, although most crypto enthusiasts know China more for their strict regulatory actions — significant restrictions on cryptocurrency investment, the inclusion of mining in the preliminary stop-list of industries that should be banned, closure of blockchain conferences by the police, and so on.

Much has changed since Facebook published their initial plans for Libra. The prospect of a private company with 2.3 billion users worldwide issuing its own currency made the idea much more real to governments around the world.

China took it as an incentive. First of all, to compete with the dollar in the digital payments market and, ultimately, to change the entire global financial system.

Looking at the example of China and understanding what the future may hold, many other countries have announced the development of their own CBDCs (Central Bank Digital Currencies). For example, central banks for the European Union, South Korea, Russia, Sweden and a number of other countries have announced their own developments in the field of state cryptocurrencies.

News about this periodically surfaced, although most crypto enthusiasts know China more for their strict regulatory actions — significant restrictions on cryptocurrency investment, the inclusion of mining in the preliminary stop-list of industries that should be banned, closure of blockchain conferences by the police, and so on.

Much has changed since Facebook published their initial plans for Libra. The prospect of a private company with 2.3 billion users worldwide issuing its own currency made the idea much more real to governments around the world.

China took it as an incentive. First of all, to compete with the dollar in the digital payments market and, ultimately, to change the entire global financial system.

Looking at the example of China and understanding what the future may hold, many other countries have announced the development of their own CBDCs (Central Bank Digital Currencies). For example, central banks for the European Union, South Korea, Russia, Sweden and a number of other countries have announced their own developments in the field of state cryptocurrencies.

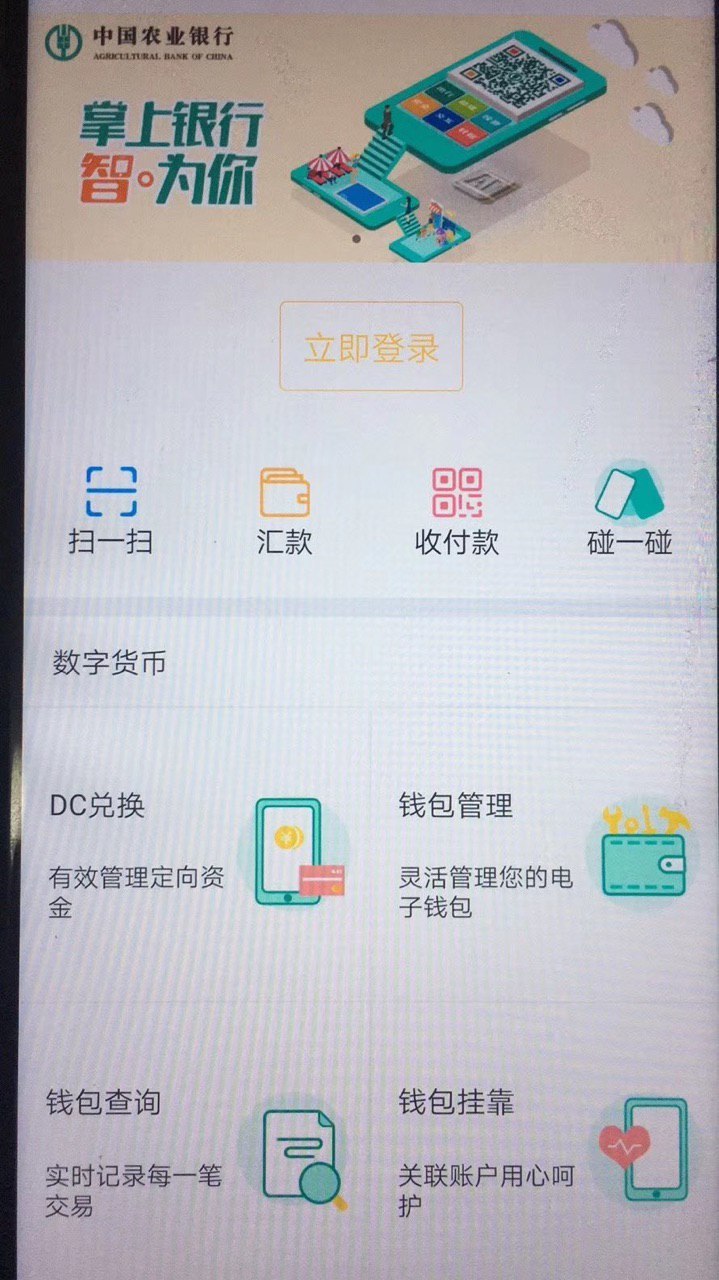

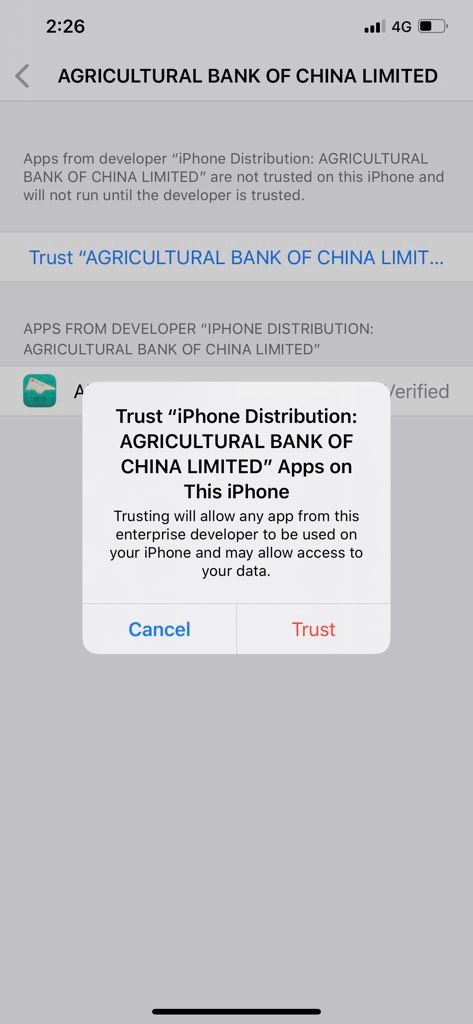

In April 2020, screenshots of the first version of the digital yuan application appeared online. According to preliminary data, the tests began among the "white list" of clients of the Agricultural Bank of China (the 7th bank in the world in terms of net profit) in four pilot regions: Shenzhen, Hong Kong, Chengdu, and Suzhou. In April, Suzhou enterprises even intend to pay 50% of transport subsidies to local workers in the new digital currency.

A couple of weeks ago, it became known that on April 25, 2020, China will launch its national blockchain platform called BSN (Blockchain Service Network). Many believe this is the first, fundamental step before the launch of a global financial project - a government-backed cryptocurrency called DC/EP. And it seems that the country is taking this initiative more seriously than ever before.

Based on the screenshots that appeared online recently, it is clear that the crypto-yuan will be launched soon enough. More and more experts are saying that this could change the entire global financial system. So, what is known at the moment and what conclusions can be drawn from it?

Based on the screenshots that appeared online recently, it is clear that the crypto-yuan will be launched soon enough. More and more experts are saying that this could change the entire global financial system. So, what is known at the moment and what conclusions can be drawn from it?

Reviewing the BSN screenshots

Several basic functions can be seen in the screenshots, and the interface is very similar to other Chinese payment platforms such as Alipay and WeChat Pay. Also, according to various statements of officials, it is already possible to understand many features and functions of the future cryptocurrency. I tried to gather all the information from different sources together.

So, what is known at the moment about the crypto yuan?

A list of all the important facts about the digital yuan:

Is this the beginning of a new financial era?

As can be seen from the information currently available, DC/EP is not the classic concept of a decentralized cryptocurrency like Bitcoin. The users themselves are unlikely to feel a significant difference in using the new system compared to WeChat Pay or AliPay. For the government, the blockchain data structure will ensure unprecedented traceability and control.

It is important to note the advantage China can gain by being the first to release a government backed digital currency at scale. Meanwhile, competing projects like Libra and Ton have been held back and forced to change by regulators.

Today, China is the second economy in the world and the least dependent on oil prices. While there's no doubt that the dollar reigns supreme today, the digital yuan is China's best chance to compete with the dollar on the global scale in the years ahead.

There is no doubt that other governments will quickly follow China's example. Perhaps we are entering a new era — the end of physical cash and the emergence of central bank cryptocurrencies. And there is a strong possibility that this will completely change the international monetary system as we know it.

To get more thoughts and insides about crypto industry you can follow my LinkedIn , Medium , Twitter

Today, China is the second economy in the world and the least dependent on oil prices. While there's no doubt that the dollar reigns supreme today, the digital yuan is China's best chance to compete with the dollar on the global scale in the years ahead.

There is no doubt that other governments will quickly follow China's example. Perhaps we are entering a new era — the end of physical cash and the emergence of central bank cryptocurrencies. And there is a strong possibility that this will completely change the international monetary system as we know it.

To get more thoughts and insides about crypto industry you can follow my LinkedIn , Medium , Twitter

• The Chinese cryptographic currency will be called DC/EP, which stands for Digital Currency Electronic Payment.

• The Central Bank has not yet officially confirmed the schedule for the introduction of the digital yuan, but many sources talk about a full launch in mid-2021.

• Besides the standard ability to receive and send payments, one of the main functions is called 'touch and touch' - it allows two people to simply touch their mobile phones to make a transfer.

• Transfers can be made without an internet connection on devices with NFC technology or Bluetooth. Offline transactions are likely to be saved and accounted for whenever the users next get online. But so far not much is known specifically about the settlement mechanism.

• Familiar features such as transfer by account number as well as generation and scanning of QR codes can already be seen on screens.

• The BSN payment system can process up to 300,000 transactions per second.

• The Chinese cryptocurrency is suitable for any financial operations because of its high throughput, including traditional retail transactions and even micropayments.

• Obviously, the crypto yuan blockchain will be centralized.

• Interestingly, the currency will not only work on the blockchain — it will be issued in two main stages: from the Central Bank to commercial banks, and from commercial banks it will already be put into circulation.

• Banks and organizations will be able to act as DC/EP issuers who can exchange the digital yuan with other fiat currencies and assets.

• Patents also indicate that DC/EP will use a two-tier architecture that allows licensed third-party payment institutions and banks to participate in the secondary issuance of digital currency.

• It appears that Alipay itself will participate in the implementation of this scheme.

• All organizations licensed to participate in the DC/EP issue will have a reserve account with the People's Bank of China.

• China also sees its own cryptocurrency as a means of counteracting new digital currencies. According to the Central Bank, a domestically issued digital currency, supported by the government and expressed in the national unit of account, can help limit the issue of private currencies and reduce the risks of financial instability.

• According to China's plan, the crypto yuan will significantly expand financial infrastructure availability in the country. At the same time, as an international means of exchange, it could improve the efficiency of cross-border payments.

• Many sources say that on March 24, the Bank of China completed the development of basic functions and began drafting laws to implement the new technology nationwide.

• One of the main challenges for the Government is to ensure that the crypto yuan enjoys the same sovereignty as the fiat yuan. Strong liquidity guarantees are promised to its holders.

• The central bank said that DC/EP is also planned to be widely used during the 2022 Olympic Games to be held in Beijing.

• The Central Bank has not yet officially confirmed the schedule for the introduction of the digital yuan, but many sources talk about a full launch in mid-2021.

• Besides the standard ability to receive and send payments, one of the main functions is called 'touch and touch' - it allows two people to simply touch their mobile phones to make a transfer.

• Transfers can be made without an internet connection on devices with NFC technology or Bluetooth. Offline transactions are likely to be saved and accounted for whenever the users next get online. But so far not much is known specifically about the settlement mechanism.

• Familiar features such as transfer by account number as well as generation and scanning of QR codes can already be seen on screens.

• The BSN payment system can process up to 300,000 transactions per second.

• The Chinese cryptocurrency is suitable for any financial operations because of its high throughput, including traditional retail transactions and even micropayments.

• Obviously, the crypto yuan blockchain will be centralized.

• Interestingly, the currency will not only work on the blockchain — it will be issued in two main stages: from the Central Bank to commercial banks, and from commercial banks it will already be put into circulation.

• Banks and organizations will be able to act as DC/EP issuers who can exchange the digital yuan with other fiat currencies and assets.

• Patents also indicate that DC/EP will use a two-tier architecture that allows licensed third-party payment institutions and banks to participate in the secondary issuance of digital currency.

• It appears that Alipay itself will participate in the implementation of this scheme.

• All organizations licensed to participate in the DC/EP issue will have a reserve account with the People's Bank of China.

• China also sees its own cryptocurrency as a means of counteracting new digital currencies. According to the Central Bank, a domestically issued digital currency, supported by the government and expressed in the national unit of account, can help limit the issue of private currencies and reduce the risks of financial instability.

• According to China's plan, the crypto yuan will significantly expand financial infrastructure availability in the country. At the same time, as an international means of exchange, it could improve the efficiency of cross-border payments.

• Many sources say that on March 24, the Bank of China completed the development of basic functions and began drafting laws to implement the new technology nationwide.

• One of the main challenges for the Government is to ensure that the crypto yuan enjoys the same sovereignty as the fiat yuan. Strong liquidity guarantees are promised to its holders.

• The central bank said that DC/EP is also planned to be widely used during the 2022 Olympic Games to be held in Beijing.