Is DeFi a Breakthrough for the Blockchain Industry?

Sergey Baloyan

Entrepreneur, X10.Agency Founder

The blockchain industry started twelve years ago with the release of Bitcoin. That was a shock, a huge slap for the traditional financial system. However, from another angle, it was a Big Bang of a Decentralized finance universe.

Right after an industry or a trend appears, a series of breakthroughs are on the way. As an example, we can take a look at the traditional financial system that has been developing for centuries. During hundreds of years, the fiat system regularly experienced tons of breakouts. Swift launch in the 20th century is one of those.

We are lucky to have a possibility to observe the Blockchain sphere development. Let's ask ourselves a question: "What is the next huge step forward for the blockchain industry after Bitcoin release?". As I have worked a lot with blockchain projects since 2017 and I can see clearly new trends in crypto, I guess the answer is on the tip of my tongue - DeFi.

Right after an industry or a trend appears, a series of breakthroughs are on the way. As an example, we can take a look at the traditional financial system that has been developing for centuries. During hundreds of years, the fiat system regularly experienced tons of breakouts. Swift launch in the 20th century is one of those.

We are lucky to have a possibility to observe the Blockchain sphere development. Let's ask ourselves a question: "What is the next huge step forward for the blockchain industry after Bitcoin release?". As I have worked a lot with blockchain projects since 2017 and I can see clearly new trends in crypto, I guess the answer is on the tip of my tongue - DeFi.

DeFi means Decentralized Finance

Besides that definition, there are two more - distributed finance or open finance.

Before discussing what it is, we'd better start with what caused DeFi to appear and why it goes forward at a great pace. New markets set modern needs and requirements that cannot be fulfilled with traditional financial systems.

Traditional finance is opaque and often experiences crises. Many are convinced that by gaining transparency society will have an efficient tool for prediction and avoiding any crisis in the future.

The main purpose of DeFi is to eliminate intermediaries such as regulators that burden the system and make processes more complicated. Achieving that goal means the arrangement of the main tools from the traditional system - lending, payments, trading and others.

Speaking in other words, DeFi will help the crypto market to become more and more familiar to the end-customer that got used to traditional finance but without one huge disadvantage - intermediary regulations.

A reasonable question might cross your mind after reading all the said above - "Why do we need a mirror of traditional finance?".

Before discussing what it is, we'd better start with what caused DeFi to appear and why it goes forward at a great pace. New markets set modern needs and requirements that cannot be fulfilled with traditional financial systems.

Traditional finance is opaque and often experiences crises. Many are convinced that by gaining transparency society will have an efficient tool for prediction and avoiding any crisis in the future.

The main purpose of DeFi is to eliminate intermediaries such as regulators that burden the system and make processes more complicated. Achieving that goal means the arrangement of the main tools from the traditional system - lending, payments, trading and others.

Speaking in other words, DeFi will help the crypto market to become more and more familiar to the end-customer that got used to traditional finance but without one huge disadvantage - intermediary regulations.

A reasonable question might cross your mind after reading all the said above - "Why do we need a mirror of traditional finance?".

If we dive deeper, we can see significant new features. I'm talking about the fund pool for fast exchange. A series of smart-contract on the blockchain on what DeFi is built allows people to benefit from the transparency and license-free features like best rate transactions through the aggregation.

In a few words, DeFi consists of crypto assets, smart-contracts, and protocols. All these items might be mixed in any kind of combination for fulfilling any purpose a user or DeFi project developer defines for themselves.

As DeFi is license-free, any user with enough crypto assets can delve into DeFi. As an example, if you have ETH you can put a deposit on DeFi project and earn interest income. It's originally done through the chain with no intermediary barrier. It's free, fast, and convenient.

Users familiar with the crypto market and industry, in particular, can already use loans, transact assets, and commit payments. Of course, for those who had never had a crypto wallet, there is an obvious threshold. You need to be experienced for assets managing.

The difficulty of using DeFi projects gradually decreases as more and more projects simplify operating and create user experience to be more convenient and easy for a wider audience.

In a few words, DeFi consists of crypto assets, smart-contracts, and protocols. All these items might be mixed in any kind of combination for fulfilling any purpose a user or DeFi project developer defines for themselves.

As DeFi is license-free, any user with enough crypto assets can delve into DeFi. As an example, if you have ETH you can put a deposit on DeFi project and earn interest income. It's originally done through the chain with no intermediary barrier. It's free, fast, and convenient.

Users familiar with the crypto market and industry, in particular, can already use loans, transact assets, and commit payments. Of course, for those who had never had a crypto wallet, there is an obvious threshold. You need to be experienced for assets managing.

The difficulty of using DeFi projects gradually decreases as more and more projects simplify operating and create user experience to be more convenient and easy for a wider audience.

What is the Current State of DeFi projects?

You can easily find Loans, DEX, financial derivatives under DeFi packages. Approximately 688 million USD in ETH and BTC are locked in DeFi projects.

Impressive.

We can't see the DeFi horizon clearly right now. It is certain now that DeFi will conquer a significant place under the crypto sun because it truly meets market needs and demand. So far, there have been two shocks - the first one is Bitcoin and the second one is DeFi. Stepping aside from its small market shares, DeFi is charged with the potential to become the next breakthrough combining crypto and traditional financial systems in one.

If you want to learn more about DeFi or you have a DeFi project and want to know more how to promote you project, please contact me via Telegram (@baloyan) or LinkedIn.

Impressive.

We can't see the DeFi horizon clearly right now. It is certain now that DeFi will conquer a significant place under the crypto sun because it truly meets market needs and demand. So far, there have been two shocks - the first one is Bitcoin and the second one is DeFi. Stepping aside from its small market shares, DeFi is charged with the potential to become the next breakthrough combining crypto and traditional financial systems in one.

If you want to learn more about DeFi or you have a DeFi project and want to know more how to promote you project, please contact me via Telegram (@baloyan) or LinkedIn.

DeFi is not just a copy of an already existing system

How China's New National Cryptocurrency Changes Everything

Sergey Baloyan

Entrepreneur, X10.Agency Founder

China is launching a national cryptocurrency. In this article, we'll tell you what information is already known about the project at the moment as well as how it may change the financial world.

A bit of History

In October 2019, Chairman of the People's Republic of China, Xi Jinping, said that the development of blockchain technology is one of the priorities of the state and called for accelerated growth of the industry. By that time, it was already known that China had been developing its own cryptocurrency since 2014.

News about this periodically surfaced, although most crypto enthusiasts know China more for their strict regulatory actions — significant restrictions on cryptocurrency investment, the inclusion of mining in the preliminary stop-list of industries that should be banned, closure of blockchain conferences by the police, and so on.

Much has changed since Facebook published their initial plans for Libra. The prospect of a private company with 2.3 billion users worldwide issuing its own currency made the idea much more real to governments around the world.

China took it as an incentive. First of all, to compete with the dollar in the digital payments market and, ultimately, to change the entire global financial system.

Looking at the example of China and understanding what the future may hold, many other countries have announced the development of their own CBDCs (Central Bank Digital Currencies). For example, central banks for the European Union, South Korea, Russia, Sweden and a number of other countries have announced their own developments in the field of state cryptocurrencies.

News about this periodically surfaced, although most crypto enthusiasts know China more for their strict regulatory actions — significant restrictions on cryptocurrency investment, the inclusion of mining in the preliminary stop-list of industries that should be banned, closure of blockchain conferences by the police, and so on.

Much has changed since Facebook published their initial plans for Libra. The prospect of a private company with 2.3 billion users worldwide issuing its own currency made the idea much more real to governments around the world.

China took it as an incentive. First of all, to compete with the dollar in the digital payments market and, ultimately, to change the entire global financial system.

Looking at the example of China and understanding what the future may hold, many other countries have announced the development of their own CBDCs (Central Bank Digital Currencies). For example, central banks for the European Union, South Korea, Russia, Sweden and a number of other countries have announced their own developments in the field of state cryptocurrencies.

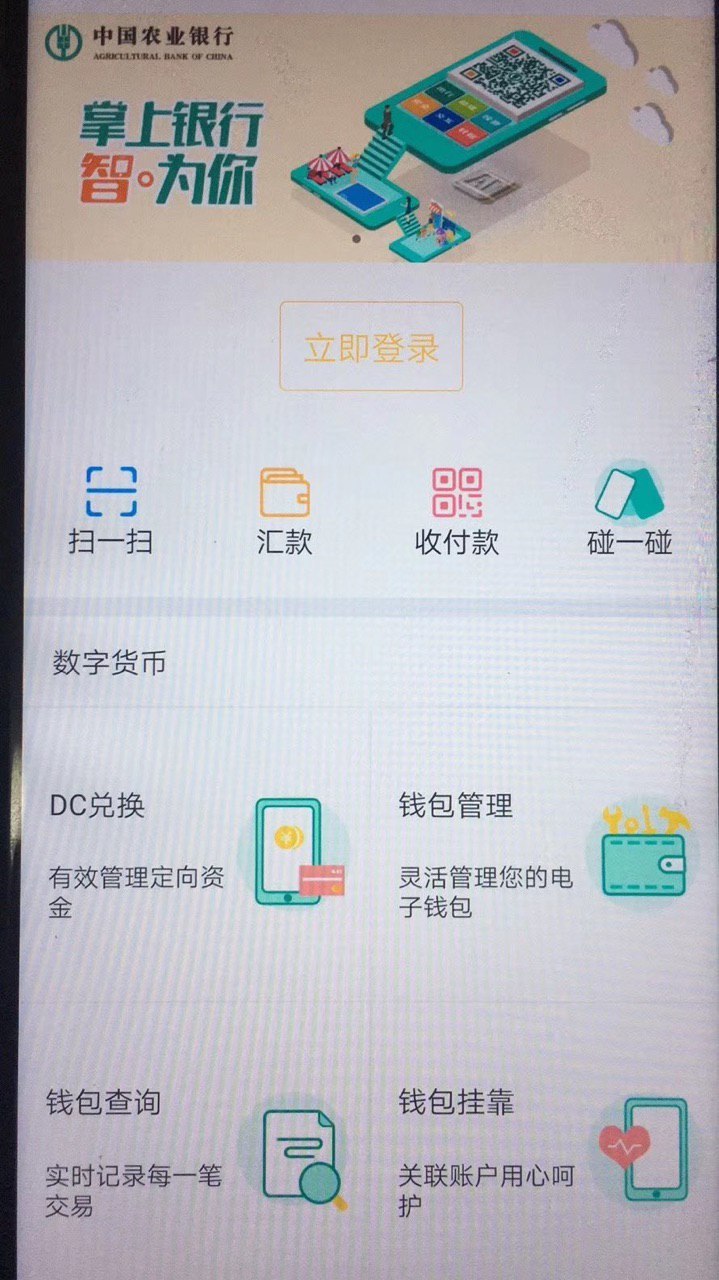

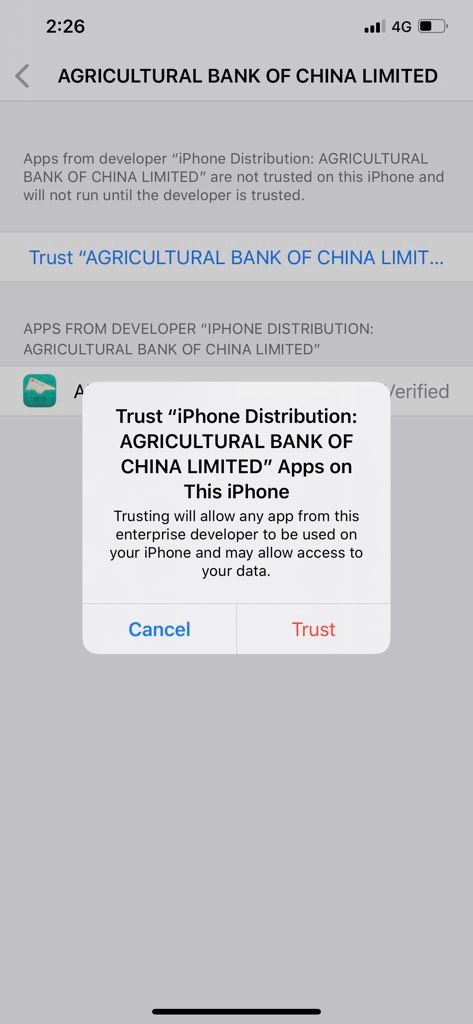

In April 2020, screenshots of the first version of the digital yuan application appeared online. According to preliminary data, the tests began among the "white list" of clients of the Agricultural Bank of China (the 7th bank in the world in terms of net profit) in four pilot regions: Shenzhen, Hong Kong, Chengdu, and Suzhou. In April, Suzhou enterprises even intend to pay 50% of transport subsidies to local workers in the new digital currency.

A couple of weeks ago, it became known that on April 25, 2020, China will launch its national blockchain platform called BSN (Blockchain Service Network). Many believe this is the first, fundamental step before the launch of a global financial project - a government-backed cryptocurrency called DC/EP. And it seems that the country is taking this initiative more seriously than ever before.

Based on the screenshots that appeared online recently, it is clear that the crypto-yuan will be launched soon enough. More and more experts are saying that this could change the entire global financial system. So, what is known at the moment and what conclusions can be drawn from it?

Based on the screenshots that appeared online recently, it is clear that the crypto-yuan will be launched soon enough. More and more experts are saying that this could change the entire global financial system. So, what is known at the moment and what conclusions can be drawn from it?

Reviewing the BSN screenshots

Several basic functions can be seen in the screenshots, and the interface is very similar to other Chinese payment platforms such as Alipay and WeChat Pay. Also, according to various statements of officials, it is already possible to understand many features and functions of the future cryptocurrency. I tried to gather all the information from different sources together.

So, what is known at the moment about the crypto yuan?

A list of all the important facts about the digital yuan:

Is this the beginning of a new financial era?

As can be seen from the information currently available, DC/EP is not the classic concept of a decentralized cryptocurrency like Bitcoin. The users themselves are unlikely to feel a significant difference in using the new system compared to WeChat Pay or AliPay. For the government, the blockchain data structure will ensure unprecedented traceability and control.

It is important to note the advantage China can gain by being the first to release a government backed digital currency at scale. Meanwhile, competing projects like Libra and Ton have been held back and forced to change by regulators.

Today, China is the second economy in the world and the least dependent on oil prices. While there's no doubt that the dollar reigns supreme today, the digital yuan is China's best chance to compete with the dollar on the global scale in the years ahead.

There is no doubt that other governments will quickly follow China's example. Perhaps we are entering a new era — the end of physical cash and the emergence of central bank cryptocurrencies. And there is a strong possibility that this will completely change the international monetary system as we know it.

To get more thoughts and insides about crypto industry you can follow my LinkedIn , Medium , Twitter

Today, China is the second economy in the world and the least dependent on oil prices. While there's no doubt that the dollar reigns supreme today, the digital yuan is China's best chance to compete with the dollar on the global scale in the years ahead.

There is no doubt that other governments will quickly follow China's example. Perhaps we are entering a new era — the end of physical cash and the emergence of central bank cryptocurrencies. And there is a strong possibility that this will completely change the international monetary system as we know it.

To get more thoughts and insides about crypto industry you can follow my LinkedIn , Medium , Twitter

• The Chinese cryptographic currency will be called DC/EP, which stands for Digital Currency Electronic Payment.

• The Central Bank has not yet officially confirmed the schedule for the introduction of the digital yuan, but many sources talk about a full launch in mid-2021.

• Besides the standard ability to receive and send payments, one of the main functions is called 'touch and touch' - it allows two people to simply touch their mobile phones to make a transfer.

• Transfers can be made without an internet connection on devices with NFC technology or Bluetooth. Offline transactions are likely to be saved and accounted for whenever the users next get online. But so far not much is known specifically about the settlement mechanism.

• Familiar features such as transfer by account number as well as generation and scanning of QR codes can already be seen on screens.

• The BSN payment system can process up to 300,000 transactions per second.

• The Chinese cryptocurrency is suitable for any financial operations because of its high throughput, including traditional retail transactions and even micropayments.

• Obviously, the crypto yuan blockchain will be centralized.

• Interestingly, the currency will not only work on the blockchain — it will be issued in two main stages: from the Central Bank to commercial banks, and from commercial banks it will already be put into circulation.

• Banks and organizations will be able to act as DC/EP issuers who can exchange the digital yuan with other fiat currencies and assets.

• Patents also indicate that DC/EP will use a two-tier architecture that allows licensed third-party payment institutions and banks to participate in the secondary issuance of digital currency.

• It appears that Alipay itself will participate in the implementation of this scheme.

• All organizations licensed to participate in the DC/EP issue will have a reserve account with the People's Bank of China.

• China also sees its own cryptocurrency as a means of counteracting new digital currencies. According to the Central Bank, a domestically issued digital currency, supported by the government and expressed in the national unit of account, can help limit the issue of private currencies and reduce the risks of financial instability.

• According to China's plan, the crypto yuan will significantly expand financial infrastructure availability in the country. At the same time, as an international means of exchange, it could improve the efficiency of cross-border payments.

• Many sources say that on March 24, the Bank of China completed the development of basic functions and began drafting laws to implement the new technology nationwide.

• One of the main challenges for the Government is to ensure that the crypto yuan enjoys the same sovereignty as the fiat yuan. Strong liquidity guarantees are promised to its holders.

• The central bank said that DC/EP is also planned to be widely used during the 2022 Olympic Games to be held in Beijing.

• The Central Bank has not yet officially confirmed the schedule for the introduction of the digital yuan, but many sources talk about a full launch in mid-2021.

• Besides the standard ability to receive and send payments, one of the main functions is called 'touch and touch' - it allows two people to simply touch their mobile phones to make a transfer.

• Transfers can be made without an internet connection on devices with NFC technology or Bluetooth. Offline transactions are likely to be saved and accounted for whenever the users next get online. But so far not much is known specifically about the settlement mechanism.

• Familiar features such as transfer by account number as well as generation and scanning of QR codes can already be seen on screens.

• The BSN payment system can process up to 300,000 transactions per second.

• The Chinese cryptocurrency is suitable for any financial operations because of its high throughput, including traditional retail transactions and even micropayments.

• Obviously, the crypto yuan blockchain will be centralized.

• Interestingly, the currency will not only work on the blockchain — it will be issued in two main stages: from the Central Bank to commercial banks, and from commercial banks it will already be put into circulation.

• Banks and organizations will be able to act as DC/EP issuers who can exchange the digital yuan with other fiat currencies and assets.

• Patents also indicate that DC/EP will use a two-tier architecture that allows licensed third-party payment institutions and banks to participate in the secondary issuance of digital currency.

• It appears that Alipay itself will participate in the implementation of this scheme.

• All organizations licensed to participate in the DC/EP issue will have a reserve account with the People's Bank of China.

• China also sees its own cryptocurrency as a means of counteracting new digital currencies. According to the Central Bank, a domestically issued digital currency, supported by the government and expressed in the national unit of account, can help limit the issue of private currencies and reduce the risks of financial instability.

• According to China's plan, the crypto yuan will significantly expand financial infrastructure availability in the country. At the same time, as an international means of exchange, it could improve the efficiency of cross-border payments.

• Many sources say that on March 24, the Bank of China completed the development of basic functions and began drafting laws to implement the new technology nationwide.

• One of the main challenges for the Government is to ensure that the crypto yuan enjoys the same sovereignty as the fiat yuan. Strong liquidity guarantees are promised to its holders.

• The central bank said that DC/EP is also planned to be widely used during the 2022 Olympic Games to be held in Beijing.