How to list your DeFi Token on Uniswap?

Sergey Baloyan

Entrepreneur, X10.Agency Founder

In our first article, we covered how to make a DeFi project successful, build a community, and organize a marketing campaign.

Preparation:

1. Install MetaMask for your browser (https://metamask.io)

2. Deploy your ERC-20 token contract to Ethereum mainnet

3. Send your ERC-20 tokens to your MetaMask wallet

2. Deploy your ERC-20 token contract to Ethereum mainnet

3. Send your ERC-20 tokens to your MetaMask wallet

7. Press 'Add' under your token's name

8. Now you can choose your token

9. Please remember that the first Liquidity Pool creation will form your initial token price. For example, if you input 1 ETH and 1 your token, that means that 1 token = 1 ETH initially. Then the market will form a fair price

10. Choose how many of your tokens and ETH you want to deposit for a pool

10. Press 'Approve {your token name}' button

11. MetaMask will require a confirmation

12. Press 'Supply' button

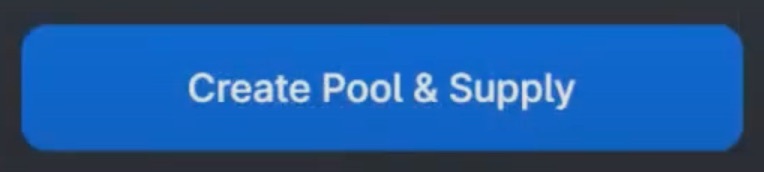

13. Approve the supply with 'Create pool and supply' button

8. Now you can choose your token

9. Please remember that the first Liquidity Pool creation will form your initial token price. For example, if you input 1 ETH and 1 your token, that means that 1 token = 1 ETH initially. Then the market will form a fair price

10. Choose how many of your tokens and ETH you want to deposit for a pool

10. Press 'Approve {your token name}' button

11. MetaMask will require a confirmation

12. Press 'Supply' button

13. Approve the supply with 'Create pool and supply' button

This article is a guide on how to list a token on UniSwap.

UniSwap is a decentralized liquidity protocol on Ethereum that allows you to list any ERC20 token. Any token can be listed and sold. Each pair is managed by a Uniswap contract and anyone, including you, can become a "liquidity provider" for a pair by putting reserves in the pair's pooled assets.

Let's say you are a crypto or DeFi project that has an ERC-20 token and you want to list it on UniSwap. Here's what you need to do.

Listing your ERC-20 token on UniSwap

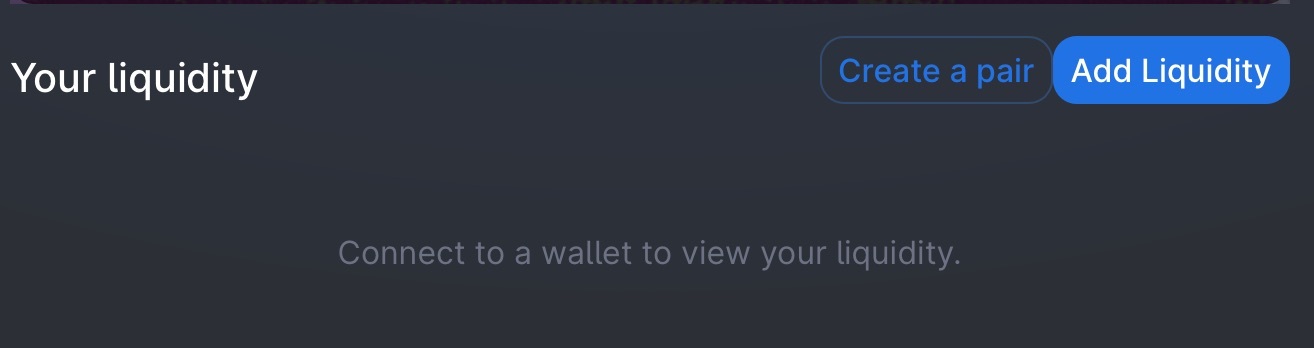

3. Click on 'Pool' tab in the up right corner

4. Click on 'Add Liquidity'

4. Click on 'Add Liquidity'

5. Click on 'Select a token' button

6. Paste your token's contract address to 'Search name or address' field, and select it from a dropdown

6. Paste your token's contract address to 'Search name or address' field, and select it from a dropdown

14. After the transaction is created you will see this

Congrats, you just listed your token to Uniswap exchange!

Now you need to find the community to buy, trade and swap it.

Partly, we spoke about it in our previous article. Be sure, to build hype around you, be included in different platforms that talk about new DeFi projects, get your marketing and community management job done right.

And we'll speak about all of this in our next articles. Stay tuned!

In the meantime, if you have any questions about DeFi or you are a DeFi project and want to know more how to promote you project, you can always contact me via Telegram (@baloyan) or LinkedIn.

Partly, we spoke about it in our previous article. Be sure, to build hype around you, be included in different platforms that talk about new DeFi projects, get your marketing and community management job done right.

And we'll speak about all of this in our next articles. Stay tuned!

In the meantime, if you have any questions about DeFi or you are a DeFi project and want to know more how to promote you project, you can always contact me via Telegram (@baloyan) or LinkedIn.

How China's New National Cryptocurrency Changes Everything

Sergey Baloyan

Entrepreneur, X10.Agency Founder

China is launching a national cryptocurrency. In this article, we'll tell you what information is already known about the project at the moment as well as how it may change the financial world.

A bit of History

In October 2019, Chairman of the People's Republic of China, Xi Jinping, said that the development of blockchain technology is one of the priorities of the state and called for accelerated growth of the industry. By that time, it was already known that China had been developing its own cryptocurrency since 2014.

News about this periodically surfaced, although most crypto enthusiasts know China more for their strict regulatory actions — significant restrictions on cryptocurrency investment, the inclusion of mining in the preliminary stop-list of industries that should be banned, closure of blockchain conferences by the police, and so on.

Much has changed since Facebook published their initial plans for Libra. The prospect of a private company with 2.3 billion users worldwide issuing its own currency made the idea much more real to governments around the world.

China took it as an incentive. First of all, to compete with the dollar in the digital payments market and, ultimately, to change the entire global financial system.

Looking at the example of China and understanding what the future may hold, many other countries have announced the development of their own CBDCs (Central Bank Digital Currencies). For example, central banks for the European Union, South Korea, Russia, Sweden and a number of other countries have announced their own developments in the field of state cryptocurrencies.

News about this periodically surfaced, although most crypto enthusiasts know China more for their strict regulatory actions — significant restrictions on cryptocurrency investment, the inclusion of mining in the preliminary stop-list of industries that should be banned, closure of blockchain conferences by the police, and so on.

Much has changed since Facebook published their initial plans for Libra. The prospect of a private company with 2.3 billion users worldwide issuing its own currency made the idea much more real to governments around the world.

China took it as an incentive. First of all, to compete with the dollar in the digital payments market and, ultimately, to change the entire global financial system.

Looking at the example of China and understanding what the future may hold, many other countries have announced the development of their own CBDCs (Central Bank Digital Currencies). For example, central banks for the European Union, South Korea, Russia, Sweden and a number of other countries have announced their own developments in the field of state cryptocurrencies.

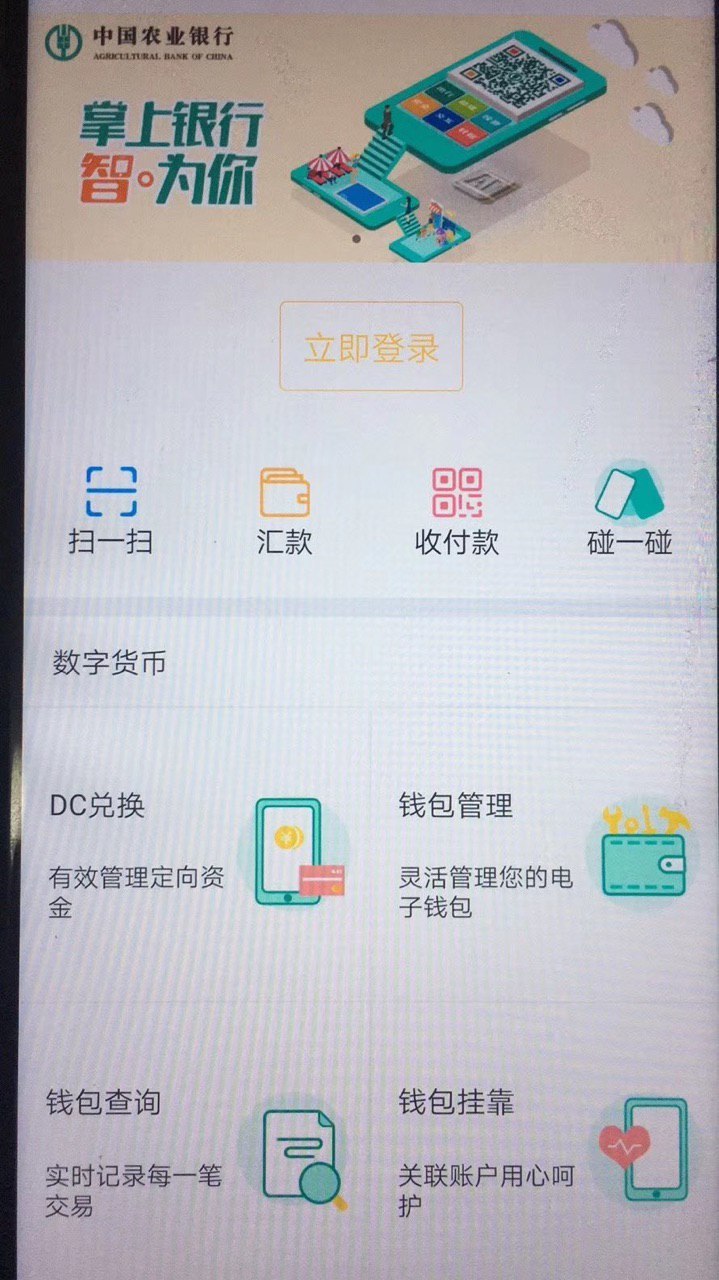

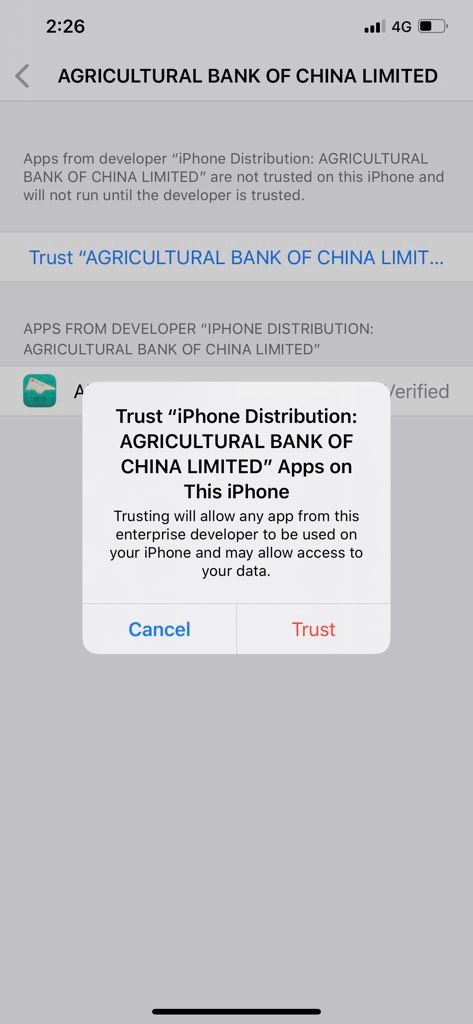

In April 2020, screenshots of the first version of the digital yuan application appeared online. According to preliminary data, the tests began among the "white list" of clients of the Agricultural Bank of China (the 7th bank in the world in terms of net profit) in four pilot regions: Shenzhen, Hong Kong, Chengdu, and Suzhou. In April, Suzhou enterprises even intend to pay 50% of transport subsidies to local workers in the new digital currency.

A couple of weeks ago, it became known that on April 25, 2020, China will launch its national blockchain platform called BSN (Blockchain Service Network). Many believe this is the first, fundamental step before the launch of a global financial project - a government-backed cryptocurrency called DC/EP. And it seems that the country is taking this initiative more seriously than ever before.

Based on the screenshots that appeared online recently, it is clear that the crypto-yuan will be launched soon enough. More and more experts are saying that this could change the entire global financial system. So, what is known at the moment and what conclusions can be drawn from it?

Based on the screenshots that appeared online recently, it is clear that the crypto-yuan will be launched soon enough. More and more experts are saying that this could change the entire global financial system. So, what is known at the moment and what conclusions can be drawn from it?

Reviewing the BSN screenshots

Several basic functions can be seen in the screenshots, and the interface is very similar to other Chinese payment platforms such as Alipay and WeChat Pay. Also, according to various statements of officials, it is already possible to understand many features and functions of the future cryptocurrency. I tried to gather all the information from different sources together.

So, what is known at the moment about the crypto yuan?

A list of all the important facts about the digital yuan:

Is this the beginning of a new financial era?

As can be seen from the information currently available, DC/EP is not the classic concept of a decentralized cryptocurrency like Bitcoin. The users themselves are unlikely to feel a significant difference in using the new system compared to WeChat Pay or AliPay. For the government, the blockchain data structure will ensure unprecedented traceability and control.

It is important to note the advantage China can gain by being the first to release a government backed digital currency at scale. Meanwhile, competing projects like Libra and Ton have been held back and forced to change by regulators.

Today, China is the second economy in the world and the least dependent on oil prices. While there's no doubt that the dollar reigns supreme today, the digital yuan is China's best chance to compete with the dollar on the global scale in the years ahead.

There is no doubt that other governments will quickly follow China's example. Perhaps we are entering a new era — the end of physical cash and the emergence of central bank cryptocurrencies. And there is a strong possibility that this will completely change the international monetary system as we know it.

To get more thoughts and insides about crypto industry you can follow my LinkedIn , Medium , Twitter

Today, China is the second economy in the world and the least dependent on oil prices. While there's no doubt that the dollar reigns supreme today, the digital yuan is China's best chance to compete with the dollar on the global scale in the years ahead.

There is no doubt that other governments will quickly follow China's example. Perhaps we are entering a new era — the end of physical cash and the emergence of central bank cryptocurrencies. And there is a strong possibility that this will completely change the international monetary system as we know it.

To get more thoughts and insides about crypto industry you can follow my LinkedIn , Medium , Twitter

• The Chinese cryptographic currency will be called DC/EP, which stands for Digital Currency Electronic Payment.

• The Central Bank has not yet officially confirmed the schedule for the introduction of the digital yuan, but many sources talk about a full launch in mid-2021.

• Besides the standard ability to receive and send payments, one of the main functions is called 'touch and touch' - it allows two people to simply touch their mobile phones to make a transfer.

• Transfers can be made without an internet connection on devices with NFC technology or Bluetooth. Offline transactions are likely to be saved and accounted for whenever the users next get online. But so far not much is known specifically about the settlement mechanism.

• Familiar features such as transfer by account number as well as generation and scanning of QR codes can already be seen on screens.

• The BSN payment system can process up to 300,000 transactions per second.

• The Chinese cryptocurrency is suitable for any financial operations because of its high throughput, including traditional retail transactions and even micropayments.

• Obviously, the crypto yuan blockchain will be centralized.

• Interestingly, the currency will not only work on the blockchain — it will be issued in two main stages: from the Central Bank to commercial banks, and from commercial banks it will already be put into circulation.

• Banks and organizations will be able to act as DC/EP issuers who can exchange the digital yuan with other fiat currencies and assets.

• Patents also indicate that DC/EP will use a two-tier architecture that allows licensed third-party payment institutions and banks to participate in the secondary issuance of digital currency.

• It appears that Alipay itself will participate in the implementation of this scheme.

• All organizations licensed to participate in the DC/EP issue will have a reserve account with the People's Bank of China.

• China also sees its own cryptocurrency as a means of counteracting new digital currencies. According to the Central Bank, a domestically issued digital currency, supported by the government and expressed in the national unit of account, can help limit the issue of private currencies and reduce the risks of financial instability.

• According to China's plan, the crypto yuan will significantly expand financial infrastructure availability in the country. At the same time, as an international means of exchange, it could improve the efficiency of cross-border payments.

• Many sources say that on March 24, the Bank of China completed the development of basic functions and began drafting laws to implement the new technology nationwide.

• One of the main challenges for the Government is to ensure that the crypto yuan enjoys the same sovereignty as the fiat yuan. Strong liquidity guarantees are promised to its holders.

• The central bank said that DC/EP is also planned to be widely used during the 2022 Olympic Games to be held in Beijing.

• The Central Bank has not yet officially confirmed the schedule for the introduction of the digital yuan, but many sources talk about a full launch in mid-2021.

• Besides the standard ability to receive and send payments, one of the main functions is called 'touch and touch' - it allows two people to simply touch their mobile phones to make a transfer.

• Transfers can be made without an internet connection on devices with NFC technology or Bluetooth. Offline transactions are likely to be saved and accounted for whenever the users next get online. But so far not much is known specifically about the settlement mechanism.

• Familiar features such as transfer by account number as well as generation and scanning of QR codes can already be seen on screens.

• The BSN payment system can process up to 300,000 transactions per second.

• The Chinese cryptocurrency is suitable for any financial operations because of its high throughput, including traditional retail transactions and even micropayments.

• Obviously, the crypto yuan blockchain will be centralized.

• Interestingly, the currency will not only work on the blockchain — it will be issued in two main stages: from the Central Bank to commercial banks, and from commercial banks it will already be put into circulation.

• Banks and organizations will be able to act as DC/EP issuers who can exchange the digital yuan with other fiat currencies and assets.

• Patents also indicate that DC/EP will use a two-tier architecture that allows licensed third-party payment institutions and banks to participate in the secondary issuance of digital currency.

• It appears that Alipay itself will participate in the implementation of this scheme.

• All organizations licensed to participate in the DC/EP issue will have a reserve account with the People's Bank of China.

• China also sees its own cryptocurrency as a means of counteracting new digital currencies. According to the Central Bank, a domestically issued digital currency, supported by the government and expressed in the national unit of account, can help limit the issue of private currencies and reduce the risks of financial instability.

• According to China's plan, the crypto yuan will significantly expand financial infrastructure availability in the country. At the same time, as an international means of exchange, it could improve the efficiency of cross-border payments.

• Many sources say that on March 24, the Bank of China completed the development of basic functions and began drafting laws to implement the new technology nationwide.

• One of the main challenges for the Government is to ensure that the crypto yuan enjoys the same sovereignty as the fiat yuan. Strong liquidity guarantees are promised to its holders.

• The central bank said that DC/EP is also planned to be widely used during the 2022 Olympic Games to be held in Beijing.